| In partnership with |  |

Despite being 20 years into the 21st Century, banking can often feel like it’s stuck in the 1900s. Slow processing times, charges for making payments (the actual injustice of being charged for paying bills is unbearable), and bank websites that look like they were coded using dial-up broadband are all part and parcel of our daily banking lives.

Setting up a bank account as a non-native to the country is particularly challenging: between inflexible bank opening hours and administrative nightmares, many moving to Denmark end up without a bank account for weeks, if not months.

“I was unable to receive my first month’s paycheque due to the bank’s slow setup process,” explains Rebecca, who moved from London to Copenhagen last November. “Nevertheless, two months later my card finally arrived.

“All the online ‘support’ I was faced with just told me to wait ‘10 working days and contact them again if nothing changes.’ Easier said than done when you can’t access your money.”

Lakeisha, who moved from London to Copenhagen in January 2019, had a similar experience:

“I think I had to wait two weeks for my card to come and a further two weeks for my pin. As a foreigner trying to sort out tax and build a life for myself here, having to pay in pounds was frustrating and stressful – especially when having to pay rent. The process was very lengthy and cost me a lot more money than necessary in the long run.”

A streamlined process could’ve prevented Lakeisha from having to make unnecessary trips to the bank. Instead, “I was told my account would be open in a couple of weeks and to return to the bank on a specific date. When I came back, I was then asked for my National Insurance number from my home country.

“There were a lot of administrative hoops to jump through.”

Now they’re finally set up with accounts, both Rebecca and Lakeisha have had difficulty using their bank’s archaic digital platforms. “It’s also a bit arduous to transfer money to friends,” explains Lakeisha. “Especially when the MobilePay app isn’t working!”

“It takes such a long time [to logon] and isn’t easy when I want to quickly assess my balance or make any quick transactions.” Adds Rebecca. “It can be hard to keep track of payments.”

Digitization has revolutionized the way we do pretty much everything and has made our phones an integral part of our lives. It’s how we take photos, listen to music, and connect with loved ones. It’s also the central hub of our day-to-day: we read emails, buy tickets for travel, check the weather, order food deliveries, and pay for shopping. Apps are woven into our personal narratives and they organically feed into our everyday moments.

If our banks are with us for the big moments – starting university, buying a house, retiring – shouldn’t they be woven into the everyday too? Without an integrated service, one that can run at our speed, they can feel like a roadblock. Nothing brings your day to a crashing holt quite like being asked to come back to the bank again next week because some other paperwork needs to be dealt with.

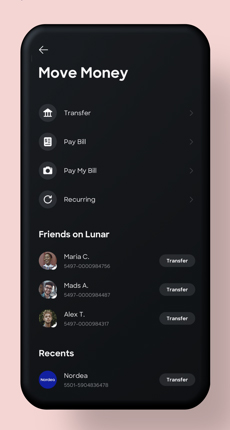

Lunar is a great solution for those looking for a bank that works with modern life. The streamlined digital bank has a user-friendly app that makes banking accessible and easy. It features various helpful functions such as budgeting, spending notifications, transfers, bill payment, and card freezing, all of which can be managed from your phone – plus it’s free to use and doesn’t charge for paying bills. Welcome to the future!

|  |

| ✔ Free transfers and free payments ✔ Sleek and beautifully designed card ✔ App with interactive budget and overviews | Lunar App |

Getting set up is as easy as using it, as it only requires a CPR number, NemID, and Danish address. It takes a few minutes to get the app up and running, then (providing there are no issues) the virtual card is ready for use within a day of opening the account – with the physical card not far behind. The PIN code is set up using the app, so you don’t have to check your mailbox every day before you can start spending.

The app is great for those who want to track their spending, as interactive budget functions give an easy overview of your finances. You can also set ‘goals,’ as a way of motivating yourself to save. It’s much more compelling to move money into something called “Cecilie Bahsen dress” than to a savings account…

|  |  |

You can manage the card and account directly from the app, meaning no more being put on hold when phoning to report a lost card and no more dashing to the bank on a lunch break.

There are plenty of reasons to feel stressed about money, but how to access it shouldn’t be one of them. After all, less time spent queuing at the bank means more time for spending on things you really love.

Say hello to the 21st Century and start banking with Lunar today – found out more.

Available in Denmark, Sweden and Norway.